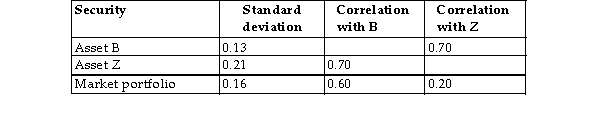

The following table provides standard deviations and correlation coefficients relating to two risky securities,B and Z,and the market portfolio.Use this information to estimate the beta and expected returns on securities B and Z,assuming an expected return on the market portfolio of 12%,and a risk- free return of 5.5%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A security with a fi of 0

Q17: An increase in systematic risk would cause

Q18: What is the beta of the market

Q19: The security market line plots the expected

Q20: Which of the following statements best describes

Q22: In general,individual stock returns appear to be

Q23: The efficient set of portfolios is _.

A)A

Q24: Which of the following statements best describes

Q25: According to the CAPM equation,which of the

Q26: What is the beta of a stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents