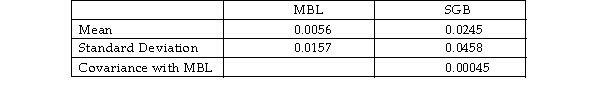

Examine the following data on MBL and SGB:  Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

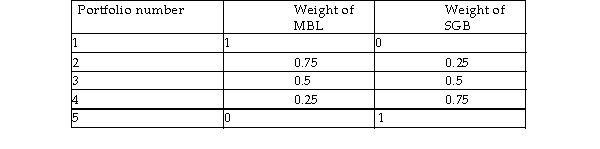

Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

Correct Answer:

Verified

Q28: The capital asset pricing model implies that

Q29: The return on treasury notes is expected

Q30: According to finance theory returns for stocks

Q31: Which of the following statements is not

Q32: (a)What are feasible portfolios?

(b)How would you construct

Q34: The beta of a share cannot be

Q35: Which of the following does not affect

Q36: Two securities with different expected returns will

Q37: The risk free asset can be expected

Q38: Use the following data to calculate the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents