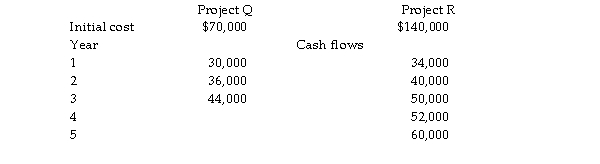

Ponsford Ltd is evaluating two projects,A and B.The relevant cash flows for each project are set out below.Both projects are similar in risk and their applicable cost of capital is 12%.  Which project should Ponsford Ltd chose?

Which project should Ponsford Ltd chose?

Correct Answer:

Verified

NPV ProjQ = $30,000(PV if 12%,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Monte Carlo analysis is also known as:

A)Scenario

Q21: ABC accounting firm estimates that new bookkeeping

Q22: Sunk costs are avoidable cash flows,or cash

Q23: Generally speaking,interest expenses should be included in

Q24: An example of a real option embedded

Q26: Woodfull Corporation bought an empty warehouse building

Q27: Jeremy's Sports Equipment is considering sponsoring a

Q28: The cash flows used in the capital

Q29: What is the size of the depreciation

Q30: Rogers Printing Pty Ltd is considering purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents