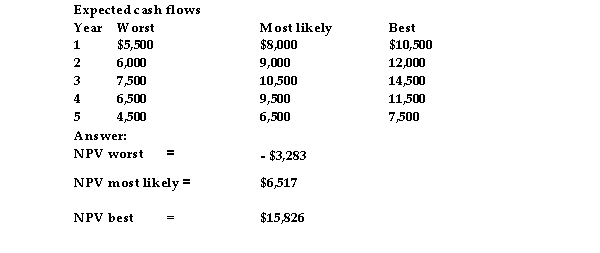

O'Reilly Ltd is considering purchasing a spinning machine which will cost $25,000.It has a five- year life and will be worthless after that.O'Reilly's cost of capital is 12%.Because of uncertainty in the economic situation the after- tax cash inflows for each of the five years are uncertain.The company has estimated expected cash flows,as shown below,for three possible economic results: worst case,most likely case and best case.Calculate the NPVs for each of the possible economic results.Is this project very risky?  Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Correct Answer:

Verified

b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Jeremy's Sports Equipment is considering sponsoring a

Q28: The cash flows used in the capital

Q29: What is the size of the depreciation

Q30: Rogers Printing Pty Ltd is considering purchasing

Q31: Cash flows used in capital budgeting should

Q33: Which of the following has the effect

Q34: When examining the change in NPV using

Q35: XHZ accounting firm estimates that new bookkeeping

Q36: When considering the taxation impact on capital

Q37: Lightweight Industries is considering purchasing a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents