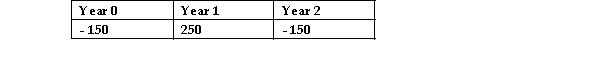

Project T has the following set of cash flows:  When evaluating Project T using an IRR technique,what problem will arise?

When evaluating Project T using an IRR technique,what problem will arise?

A) Projects cannot have negative cash flows in any year other than year 0.

B) The projects IRR is impossible to determine.

C) The project will have multiple IRRs.

D) No problem should arise.

Correct Answer:

Verified

Q7: Capricorn Industries Ltd is considering three mutually

Q8: Project B has an IRR of 12%.The

Q9: Which of the following capital budgeting evaluation

Q10: Project Alpha has the following net cash

Q11: What is the numerator in the average

Q13: Which of the following is a limitation

Q14: What is the difference between the normal

Q15: TSR Ltd is considering investing in a

Q16: The net present value of a project

Q17: CMM Investments must choose one investment from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents