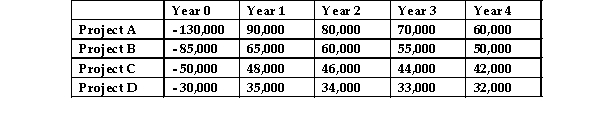

CMM Investments must choose one investment from four possible alternatives.The initial costs and cash flows produced by each alternative are given in the table below:  CMM Investments has a cost of capital of 15% p.a.If CMM Investments prefers to use the NPV technique to make their investments decisions,which project will they choose?

CMM Investments has a cost of capital of 15% p.a.If CMM Investments prefers to use the NPV technique to make their investments decisions,which project will they choose?

A) Project A

B) Project B

C) Project C

D) Project D

Correct Answer:

Verified

Q12: Project T has the following set of

Q13: Which of the following is a limitation

Q14: What is the difference between the normal

Q15: TSR Ltd is considering investing in a

Q16: The net present value of a project

Q18: Kinloch Ltd has just purchased a new

Q19: Project Rosie is a two- year project

Q20: Which of the following does not constitute

Q21: Which of the following investment evaluation techniques

Q22: Outline the primary limitations of the payback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents