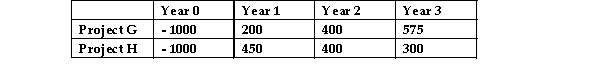

ABC Ltd and DEF Ltd are each considering the same two investment projects;Project G and Project H.These two projects are mutually exclusive.The cash flows produced by each project are the same for both companies.These cash flows are given below:  The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

A) ABC Ltd should chose Project G and DEF Ltd should chose Project G.

B) ABC Ltd should chose Project H and DEF Ltd should chose Project H.

C) ABC Ltd should chose Project H and DEF Ltd should chose Project G.

D) ABC Ltd should chose Project G and DEF Ltd should chose Project H.

Correct Answer:

Verified

Q30: Project Rocket costs $10,000 to invest in

Q31: Which of the following is not a

Q32: Zoolander Industries is considering purchasing Tyco Manufacturing

Q33: Project Emma cost $15,000 and has the

Q34: What is the denominator in the average

Q36: Which of the following is not a

Q37: If the net present value is positive,the

Q38: Which of the following projects would be

Q39: Which of the following is likely if

Q40: Project A has a cost of $1,260

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents