taxis Industries is considering a project that would involve the purchase and refitting of a new manufacturing facility.The following information is known about this project:  The initial cost of the purchase and refit of the facility is $300,000,000.There is expected to be no salvage value.

The initial cost of the purchase and refit of the facility is $300,000,000.There is expected to be no salvage value.

The facility can be depreciated using straight- line depreciation over a four- year life The current tax rate is 36%

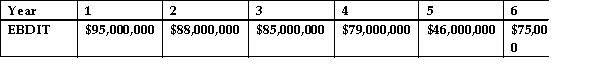

A)What is the average accounting rate of return on the project?

B)Based upon this result should Tavis Industries accept this project?

Correct Answer:

Verified

Average income =...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: IRR is superior to NPV as an

Q24: Project X has an initial cost of

Q25: Studies have shown that DCF techniques are

Q26: Project Y is a two- year project

Q27: Which of the following projects would be

Q29: Project A has a positive NPV.What should

Q30: Project Rocket costs $10,000 to invest in

Q31: Which of the following is not a

Q32: Zoolander Industries is considering purchasing Tyco Manufacturing

Q33: Project Emma cost $15,000 and has the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents