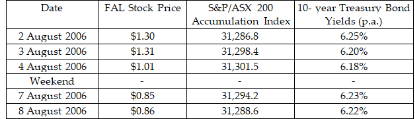

Falcon Technologies (FAL)Ltd announced at 10:15am on the 4 August 2006 an increase in EPS of 10% relative to the previous year.The following table shows the share price of FAL and the value of the S&P/ASX 200 index around the time of the announcement.

Using this information answer the following questions:

a) What are the abnormal returns surrounding the earnings announcement of Falcon Technologies?

b) How has the market reacted to the earnings announcement? How can you explain this reaction?

c) Are the abnormal returns generated by FAL around its EPS announcement consistent with the concept of market efficiency? What level of efficiency does this example allow us to comment upon? Explain.

Correct Answer:

Verified

b)

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Ball (1978)tested a trading strategy known as

Q17: Which of the following is not a

Q18: According to the theory of market efficiency,

A)Prices

Q19: Aitken and Frino (1996)examined the price reactions

Q20: On 6 January 2009 Fine Textiles (FTX)Ltd

Q22: Which of the following describes a weak

Q23: On 6 January 2006 Fine Textiles (FTX)Ltd

Q24: You have been following an investment strategy

Q25: Which of the following is not a

Q26: On 30 December 2009 BMP Ltd releases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents