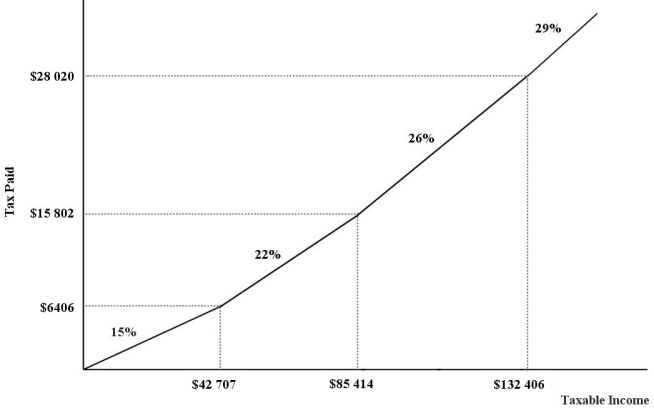

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.What must be true of the four marginal income- tax rates in order for the tax to be considered a "flat" tax?

A) they need to be the same

B) they need to be smaller

C) they need to gradually level out

D) they need to be zero

E) they need to be constant

Correct Answer:

Verified

Q46: The excess burden of a tax reflects

Q47: The Canada Health Transfer (CHT)and the Canada

Q48: The Canada (and Quebec)Pension Plans (CPP and

Q49: Consider the concept of equity in taxation.What

Q50: Suppose a firm buys $1000 worth of

Q52: In Canada,the corporate income tax is integrated

Q53: In Canada,taxes are levied and collected by

A)federal

Q54: The tax that generates the greatest proportion

Q55: The direct burden of a tax is

Q56: From the perspective of individuals,the goods and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents