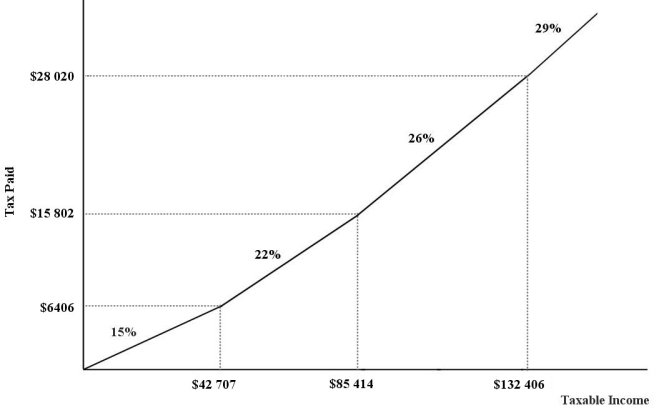

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.This income- tax system can be characterized as

A) cumbersome.

B) regressive.

C) progressive.

D) proportional.

E) fair.

Correct Answer:

Verified

Q71: If a tax system contains some important

Q72: Because government benefits paid by most universal

Q73: Social and economic policies often involve a

Q74: What is a demogrant?

A)A social benefit that

Q75: Which of the following statements suggests that

Q77: An income tax is progressive if,as income

Q78: The Employment Insurance (EI)system operates whereby

A)eligible unemployed

Q79: Consider a 10% excise tax that is

Q80: Consider the allocation of a nation's resources

Q81: The two main competing goals in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents