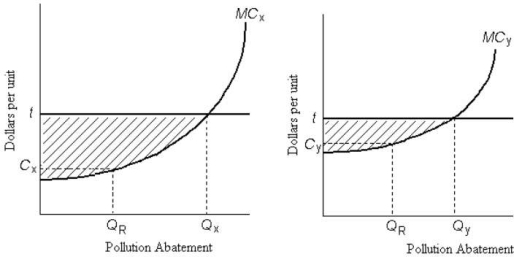

The diagram below shows the marginal cost of pollution abatement for two firms,Firm X and Firm Y.

FIGURE 17- 4

FIGURE 17- 4

-Refer to Figure 17- 4.There is an emissions tax of $t per unit of pollution.Which of the following statements regarding the pollution abatement activities by the two firms is correct?

A) The emissions tax causes no change in the firms' polluting activity.

B) It is efficient for Firm Y to do less pollution abatement than Firm X because Firm Y faces higher costs of abatement.

C) It is not socially optimal to have Firm X doing pollution abatement of QX while Firm Y does the lesser amount,QY.

D) The emissions tax causes an optimal level of pollution.

E) The shaded areas in the two graphs depict the social costs of pollution caused by Firms X and Y.

Correct Answer:

Verified

Q98: The diagram below shows a market for

Q99: An important reason that direct controls are

Q100: Refer to Figure 17- 4.Ignore the horizontal

Q101: The diagram below shows a market for

Q102: The diagram below shows a market for

Q104: The diagram below shows the private and

Q105: The optimal amount of pollution abatement is

Q106: Direct pollution controls are usually inefficient because

Q107: Consider a coal- fired electric- power plant

Q108: The table below shows the marginal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents