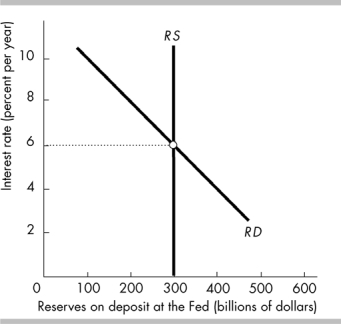

-The figure above shows the market for bank reserves in Futureland. If the Bank of Futureland undertakes an open market sale of government securities that changes the quantity of reserves by

$100 billion, then the federal funds rate will___________ .

A) rise to 8 percent a year

B) fall to 4 percent a year

C) remain at 6 percent a year

D) None of the above answers is correct.

Correct Answer:

Verified

Q51: If the Fed wants to raise the

Q52: When the federal funds interest rate is

Q53: Long-term interest rates are _ than short-term

Q54: An open market sale of government securities

Q55: To lower the federal funds rate, the

Q57: Monetary policy includes adjustments in_so as to

Q58: Monetary policy affects real GDP by

A) creating

Q59: If the interest rate on Treasury bills

Q60: If the Fed buys U.S. government securities,

A)

Q61: When the Fed raises the federal funds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents