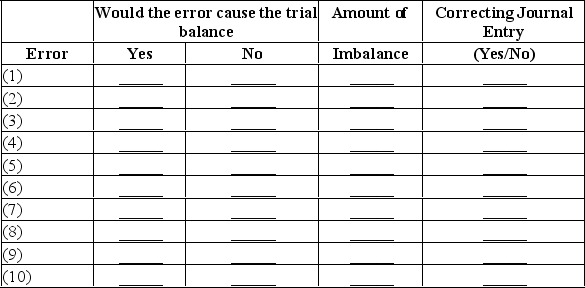

At year-end, the accountant for D. Yee Chiropractic Service noted the following errors in the trial balance:

The bookkeeper understated the total credits to the Accourts Payable account by when calculating the account balance.

A cash sale for was recorded as a credit to the unearned reverue account, but the servicehad been provided to the customer at the time of the cash exchange.

A cash receipt from a customer for was never recorded.

The balance of the Prepaid Rent account was listed in the credit colurm of the trial balance.

A car purchase was recorded as a debit to Vehicles and a credit to Notes Payable.

A purchase of office supplies for was recorded as a debit to Supplies Expense. The off setting credit entry was correct.

An additional investrnent of by D. Yee chiropractic Was recorded as a debit to D. Yee, Capital and as a credit to Cash.

The payment of the utility bill for Decermber was recorded twice.

The reverue account balarnce of was listed on the trial balance as .

A withdrawal made by the owner was recorded to the correct accounts as .

Using the form below, indicate if each error would cause the trial balance to be out of balance, the amount of any imbalance, and if a correcting entry is required.

Correct Answer:

Verified

Q116: Unearned revenue is reported in the financial

Q128: The adjusted trial balance contains information pertaining

Q143: Before recording adjusting entries on December 31,

Q145: If the accountant failed to make the

Q146: The unadjusted trial balance for a company

Q148: A trial balance prepared before any adjustments

Q149: Throughout an accounting period, the fees for

Q150: In reviewing the accounts of Tumblers Co.,

Q151: If an accountant forgot to record depreciation

Q152: A receipt of $15,700 cash from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents