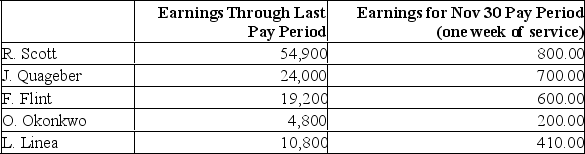

Spieth Company employees had the following earnings records at the close of the November 30 payroll period.

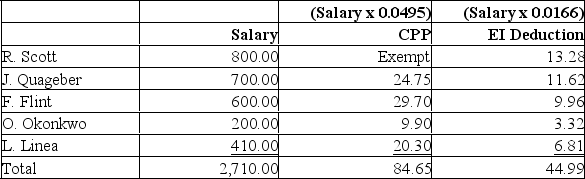

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Note that R. Scott would have already paid the maximum CPP and EI for the year

Note that R. Scott would have already paid the maximum CPP and EI for the year

Correct Answer:

Verified

Q51: An amount of an employee's annual earnings

Q52: Small Company's 16 sales personnel earned total

Q53: Valentina company has 9 employees who earned

Q54: Haines Company prepared the following payroll summary

Q55: Stellar Company employees had the following earnings

Q56: A tax levied by a province, the

Q57: A company's 18 sales personnel earned salaries

Q58: The amount an employee earns before any

Q59: A company has 10 employees who earned

Q61: Jack Slack is CEO of Slack Industries.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents