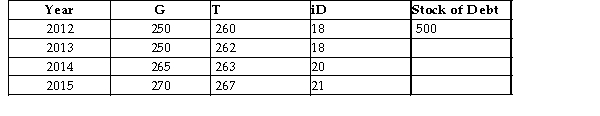

The table below shows government purchases G) , net tax revenues T) , and debt-service payments iD) over a 4-year period for a hypothetical economy. All figures are in billions of dollars. Assume the stock of debt at the end of 2012 is $500 billion.  TABLE 31-1

TABLE 31-1

-Consider two economies, A and B. Economy A has a stock of government debt equal to $800 billion and a

Debt-to-GDP ratio of 10%. Economy B has a stock of government debt equal to $22 billion and a debt -to-GDP ratio of 80%. What is the GDP for each economy?

A) Economy A: GDP = $8 trillion Economy B: GDP = $27.5 billion

B) Economy A: GDP = $80 billion Economy B: GDP = $18.7 billion

C) Economy A: GDP = $80 trillion Economy B: GDP = $275 billion

D) Economy A: GDP = $800 billion Economy B: GDP = $22 billion

E) Economy A: GDP = $8 trillion Economy B: GDP = $2.75 billion

Correct Answer:

Verified

Q21: Suppose during one fiscal year,government purchases are

Q21: The table below shows government purchases (G),net

Q22: Suppose the stock of government debt in

Q25: If the government's total budget surplus is

Q31: Suppose the stock of government debt in

Q32: The Canadian federal government's debt-to-GDP ratio climbed

Q35: The table below shows government purchases (G),net

Q38: If the governmentʹs total budget deficit is

Q39: The table below shows government purchases (G),net

Q40: The Canadian federal government's net debt as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents