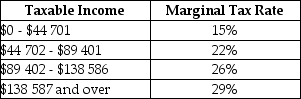

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the minimum rate of 15%?

A) $0

B) $6705

C) $8003

D) $18 000

E) $34 800

Correct Answer:

Verified

Q20: Q21: The table below shows 2015 federal income-tax Q22: The table below shows 2015 federal income-tax Q23: The most important source of revenue for Q24: The table below shows 2015 federal income-tax Q26: Suppose a firm buys $3000 worth of Q27: In 2015,the federal income-tax rate was graduated Q28: As a proportion of Gross Domestic Product Q29: Suppose a firm buys $1000 worth of Q30: The tax that generates the greatest proportion![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents