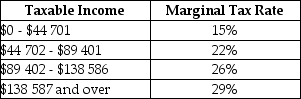

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

A) $1629

B) $17 004

C) $9834

D) $26 400

E) $28 020

Correct Answer:

Verified

Q26: Suppose a firm buys $3000 worth of

Q27: In 2015,the federal income-tax rate was graduated

Q28: As a proportion of Gross Domestic Product

Q29: Suppose a firm buys $1000 worth of

Q30: The tax that generates the greatest proportion

Q32: The various provincial sales taxes are mildly

Q33: In Canada,taxes are levied and collected by

A)the

Q34: The Canadian federal income tax is progressive

Q35: From the perspective of individuals,the goods and

Q36: The table below shows 2015 federal income-tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents