Management of the Davidson Company is currently considering the possibility of changing from the FIFO method to the LIFO method of inventory valuation for income tax and financial reporting purposes. The company's president, Dan Davidson, is concerned that using LIFO will tend to distort the company's balance sheet over time. He believes that the difference between the current cost of the company's inventory and the reported LIFO valuation will tend to grow larger each year, and that the company's reported LIFO inventory valuation will be progressively understated in relation to current cost. Davidson Company relies heavily on short-term bank credit, and Mr. Davidson feels that the company's bankers will tend to downgrade the company's short-term debt-paying ability if a switch to LIFO is made.

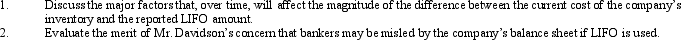

Required:

Correct Answer:

Verified

Q111: The following data relate to the records

Q112: The Steelers Company had its entire inventory

Q113: The inventory write-down rule under IAS 2

Q114: Kingston Company reported the following net income

Q116: The inventory account of Duke Company at

Q117: The following data are available for Castle

Q118: The 49ers Company began its operations in

Q120: Boston Company reported the following net income

Q121: The skeleton of the basic retail inventory

Q132: The claim is sometimes made that the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents