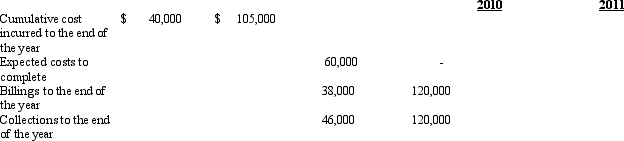

Superior Builders has a fixed -price contract providing $120,000 of revenue. Construction on the contract was begun in 2010 and was completed in 2011. Information relating to the contract is as follows:

What amount of income should Superior recognize in 2011 assuming that the company appropriately uses the percentage-of-completion method of income recognition?

A) $9,286

B) $15,000

C) $17,000

D) $7,000

Correct Answer:

Verified

Q52: Assume the Randall Corporation sold $30,000 worth

Q54: On January 3, 2011, Lincoln Services, Inc.,

Q55: Knudsen Company sold $300,000 to customers on

Q56: On January 1, 2011 Rose Enterprises obtained

Q58: Under which of the following circumstances is

Q59: Grover, Inc., appropriately uses the installment sales

Q60: The completed-contract method (as opposed to the

Q61: The importance of revenue to a business

Q62: Revenue is measured in terms of the

Q62: CellMate, a cellular phone company, conducts a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents