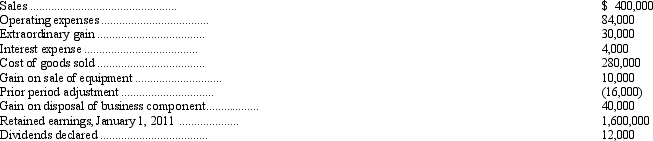

The following pretax amounts pertain to the Brooke Corp. for the year ended December 31, 2011.

The effective corporate tax rate is 30 percent. The company had 10,000 shares of common stock outstanding for the entire year.

Correct Answer:

Verified

Q65: A classic definition of income states that

Q72: Elwood P. Dowd Company has two divisions,

Q73: The changes in the account balances and

Q75: An example of direct matching of an

Q76: Landon, Inc., has several operating divisions. In

Q77: All of the following would appear on

Q77: Which of the following would be treated

Q80: Provo Water Products had sales during 2011

Q81: A significant part of the compensation received

Q82: Indicate which of the items below should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents