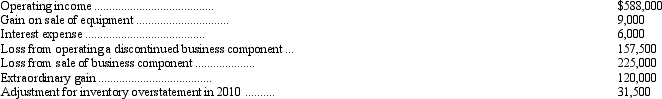

Jaguar Corp. reported the following pretax amounts for the year ending December 31, 2011:

The income tax rate applicable to Jaguar is 30 percent. Prepare a partial income statement for the year ending December 31, 2011, beginning with "Income from continuing operations before income taxes." Include the presentation of earnings per share, assuming 50,000 shares were outstanding during the year.

Correct Answer:

Verified

Q56: The following information is available for Avalon

Q57: Voyager Corporation separates operating expenses in two

Q58: The financial statements of Cresent Corporation for

Q59: Byron Inc. decided on August 1, 2011,

Q60: The following expenses were recognized by Kalob

Q62: Greene Enterprises, Inc., has two operating divisions,

Q63: Which of the following is true regarding

Q64: The forecast of income for future periods

Q65: Panther Corp. purchased a patent on January

Q66: Huntington Company has two divisions, A and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents