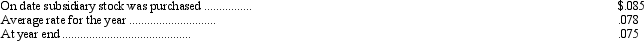

Tokyo Enterprises, a subsidiary of Worldwide Enterprises based in Dallas, reported the following information at the end of its first year of operations (all in yen) : assets--110,000,000; expenses--41,000,000; liabilities--97,500,000; capital stock--5,500,000; revenues--48,000,000. Relevant exchange rates are as follows:

As a result of the translation process, what amount is recorded on the financial statements as the translation adjustment?

A) $21,000 debit adjustment

B) $76,000 debit adjustment

C) $21,000 credit adjustment

D) $76,000 credit adjustment

Correct Answer:

Verified

Q1: Which of the following is not correct

Q3: Albright Distributing Inc. converts its foreign subsidiary

Q4: Maxim Importing Company. converts its foreign subsidiary

Q5: Complete the following statement by choosing the

Q7: Which of the following is not a

Q7: Which of the following statements is correct?

A)

Q9: The SEC currently requires foreign companies that

Q10: Which of the following is theleast likely

Q11: Which of the following is not a

Q13: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents