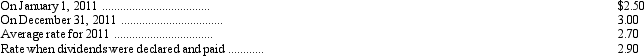

Fleming Company. converts its foreign subsidiary financial statements using the translation process. The company's subsidiary in Denmark reported the following for 2011: revenues and expenses of 80,000 and 54,000 kroner, respectively, earned or incurred evenly throughout the year, dividends of 32,000 kroner were paid during the year. The following exchange rates are available:

Translated net income for 2011 is

A) $70,200.

B) $78,000.

C) $(16,200) .

D) $(8,400) .

Correct Answer:

Verified

Q11: The primary purpose of the Security and

Q20: A translation adjustment resulting from the translation

Q22: Sarkozy Enterprises, a subsidiary of Obama Company

Q23: Under international accounting standards,cash paid for income

Q27: Brown Enterprises, a subsidiary of Biden Company

Q28: Under international accounting standards,cash paid for interest

Q28: Under international accounting standards, cash received from

Q31: Which of the following statements is true

Q35: Under international accounting standards,revenue is recognized

A) only

Q37: Under international accounting standards,the standard for accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents