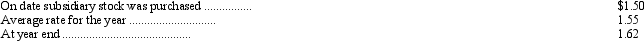

Rome Enterprises, a subsidiary of La Italia Company based in New York, reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000; expenses--340,000; liabilities--880,000; capital stock--80,000, revenues--400,000. Relevant exchange rates are as follows:

As a result of the translation process, what amount is recorded on the financial statements as the translation adjustment?

A) $25,200 debit adjustment

B) $34,800 debit adjustment

C) $34,800 credit adjustment

D) $25,200 credit adjustment

Correct Answer:

Verified

Q22: Which of the following is the current

Q27: Under international accounting standards,which of the following

Q35: Under international accounting standards, the derecognition of

Q38: Which of the following is true regarding

Q38: Under international accounting standards,cash received from interest

Q41: On July 15, 2011, United Manufacturing Inc.,

Q43: Under international accounting standards, if a sale-leaseback

Q44: Sunset Technological, Inc., a U.S. multinational producer

Q45: Reagan Corporation, a U.S. company, owns a

Q57: The measurement of deferred tax liabilities and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents