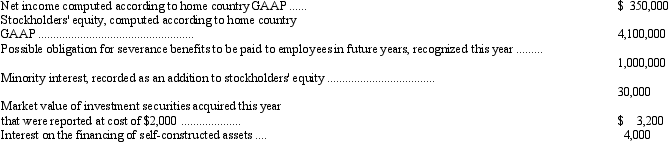

The following financial information is for Olaf Company, a non-U.S. firm with shares listed on a U.S. stock exchange:

If Olaf Company were following U.S. GAAP, the minority interest would have been classified as a liability instead of as part of stockholders' equity. In addition, minority interest income of $3,000 for the year would have been excluded from the computation of net income. Under U.S. GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Olaf's reported stockholders' equity and net income to U.S. GAAP.

Correct Answer:

Verified

Q41: Under international accounting standards,the pension-related asset or

Q43: Under international accounting standards, if a sale-leaseback

Q44: Sunset Technological, Inc., a U.S. multinational producer

Q45: Reagan Corporation, a U.S. company, owns a

Q46: Financial information for Toro Enterprises at the

Q48: The following financial information is for DC

Q49: Mankato, Inc., purchased Kyoto Manufacturing Company, a

Q51: Under international accounting standards, deferred tax assets

Q52: Which of the following is correct regarding

Q57: The measurement of deferred tax liabilities and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents