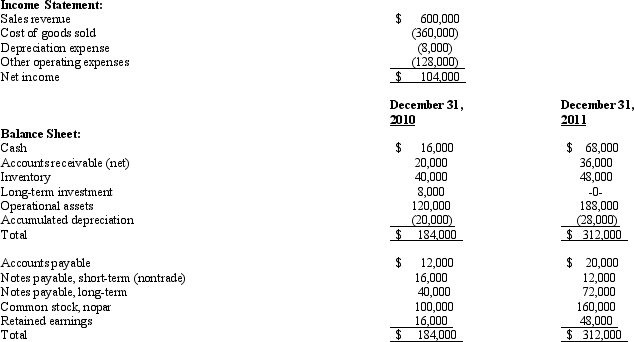

The records of George Company provided the following information for the year ended December 31, 2011:

Additional Information:

1. Sold the long-term investment at cost, for cash. The securities were classified as available-for-sale. The market value had not changed since acquisition.

2. Declared and paid a cash dividend of $28,000.

3. Purchased operational assets that cost $68,000 by giving a $48,000 long-term note payable and by paying $20,000 cash.

4. Paid a $16,000 long-term note payable by issuing common stock having a market value of $16,000.

5. Issued a stock dividend of $44,000.

Required:

Prepare a statement of cash flows using the direct method for George Company for the year ending December 31, 2011.

Correct Answer:

Verified

State...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Which of the following need not be

Q49: A firm purchased $20,000 worth of investments

Q52: A company's income statement disclosed $45,000 of

Q53: Daniels Company reported sales of $800,000, bad

Q55: The conversion of nonparticipating preferred stock into

Q55: What is the effect of the sale

Q56: If a company issues both a balance

Q60: A company sold an investment in trading

Q61: The following information for Clayton Company is

Q65: A loss on the sale of machinery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents