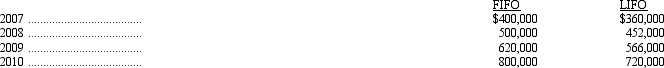

On January 1, 2011, Wiley Corporation changed its inventory cost flow assumption from FIFO to LIFO. The change was made for financial statement and tax reporting. Wiley's inventory values at the end of each year since inception under both methods are summarized below.

Ignoring income taxes, what is the amount of adjustment required in the 2011 accounts, and where would it be reported in the financial statement?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Which of the following is not a

Q62: Managers often are accused of making accounting

Q63: Ideally,managers should make accounting changes only as

Q64: Johnson's Distributing purchased equipment on January 1,

Q67: Stone Enterprise purchased a machine on January

Q68: Lambert Enterprises acquired Callahan Company for $700,000

Q69: Cameron Co. began operations on January 1,

Q70: On January 1, 2011, Nicole Corporation changed

Q71: In reviewing the books of Meyers Retailers

Q73: Since its organization on January 1, 2009,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents