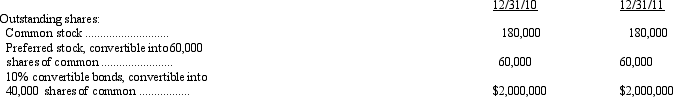

The following information relates to the capital structure of Metcalf Corp.:

During 2011 Metcalf paid $90,000 in dividends on the preferred stock. Metcalf's net income for 2011 was $1,960,000 and the income tax rate was 40 percent. For the year ended December 31, 2011, the diluted earnings per share is

A) $7.29.

B) $7.43.

C) $8.17.

D) $8.29.

Correct Answer:

Verified

Q22: During its fiscal year, Richards' Distributing had

Q23: Landrover, Inc. had 150,000 shares of common

Q24: On December 31, 2010, Superior, Inc. had

Q25: At December 31, 2010, Dayplanner Inc. had

Q25: For companies with a complex capital structure,a

Q27: At December 31, 2011, the Murdock Company

Q28: Zacor Incorporated has 2,500,000 shares of common

Q29: The JVB Corporation had 200,000 shares of

Q30: The Thomas Company's net income for the

Q31: An entity that reports a discontinued operation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents