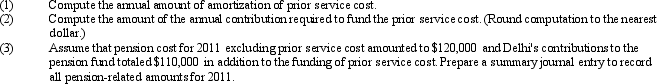

On January 1, 2011, the Delhi Corp. amended its defined benefit pension plan to provide increased retirement benefits for its 150 employees covered by the plan on that date. As a result of the plan amendment, the projected benefit obligation as of January 1, 2011, increased by $1,275,000. Management decided to amortize this amount on a straight-line basis over the average remaining service life of the 150 employees. It is assumed that employees will retire at the rate of six employees per year over the next 25 years. The prior service cost is to be funded with equal annual contributions over a ten-year period. The first contribution is due at the end of 2011 and the assumed interest rate for funding purposes is 12 percent. The present value factor for an ordinary annuity for ten periods at 12 percent is 5.6502.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Summers, Inc., pays its managers a bonus

Q58: Records for the Carp Corporation's defined-benefit pension

Q59: Interest cost relating to defined-benefit pension plans

Q60: Danny Ocean Corporation has an incentive compensation

Q62: As an incentive, Wilson Enterprises awards an

Q63: Arctic Ice Inc. compensates its employees for

Q64: Natural Products, Inc., has a noncontributory, defined-benefit

Q65: On August 31, 2011, payroll data from

Q66: Colton Company sponsors a defined-benefit pension plan.

Q73: One component of net pension expense,unrecognized gains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents