Cardinal Industries computed a pretax financial income of $118,500 for the first year of its operations ended December 31, 2011. Cardinal uses an accelerated cost recovery method on its tax return, and straight-line depreciation on its books.

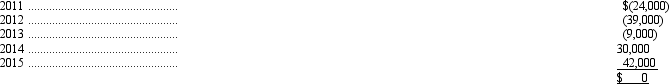

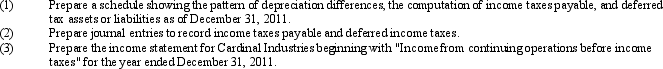

The difference between the tax and book deduction for depreciation over the five-year life of the assets acquired in 2011 are as follows:

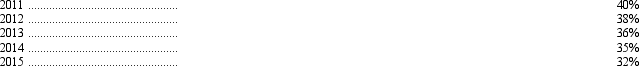

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No. 109 and assume that it is more likely than not that income will be sufficient in all future years to realize any deductible amounts.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Which of the following is an example

Q57: For the current year, Northern Pacific Company

Q58: Which of the following is not a

Q60: For the current year, Northern Pacific Company

Q61: The application of SFAS No.109 results in

Q65: The data shown below represent the complete

Q69: A major conceptual issue associated with interperiod

Q85: SFAS No.109 rejected the approach of its

Q86: IAS No.12,"Income Taxes," contains the provisions relating

Q87: SFAS No.109 allows the recognition of deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents