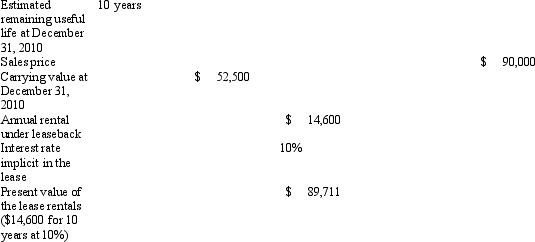

On January 1, 2011, Larsen Corporation sold a machine to Parson Corporation and simultaneously leased it back for ten years. The following information is available regarding the lease:

How much profit should Larsen recognize on January 1, 2011, on the sale of the machine?

A) $0.

B) $37,211

C) $90,000

D) $37,500

Correct Answer:

Verified

Q41: An asset with a market value of

Q42: On December 1, 2011, Blake Inc. signed

Q43: Lofgreen Company leased an asset for use

Q44: A lessee wants to lease an asset

Q45: Marshall, Inc., leased equipment to Gadsby Company

Q47: Walker, Inc., leased a machine from Holden

Q48: Wallace Corporation entered into a direct financing

Q48: In a lease that is recorded as

Q50: Potter Corporation leased used equipment to Weasley,

Q51: The lessor capitalizes and amortizes initial direct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents