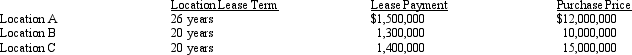

Henri Retail Stores is negotiating three leases for store locations. Henri's incremental borrowing rate is 12 percent. Each store will have an economic useful life of 30 years. Lease payments will be made at the end of each year. Based on the data below, properly classify each of the leases as an operating lease or a capital lease. The purchase price for each property is listed as an alternative to leasing.

Determine whether each of the leases should be classified by Henri as an operating lease or a capital lease. Show computations and reasons to support your answers.

Correct Answer:

Verified

Q69: Standard Distributing entered into a leasing agreement

Q72: Garrison leased a special crane to Keillor

Q73: On January 2, 2011, the Wilcox Studios

Q75: On January 1, 2011, Franklin Industries leased

Q76: Business leasing has become a large market.Banks,other

Q76: On January 1, 2011, R. L. Bowman,

Q77: Spartan Corporation has entered into a debt

Q78: Which of the following is true regarding

Q78: GW Company operates a large regional railway

Q79: George Harmon is the president of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents