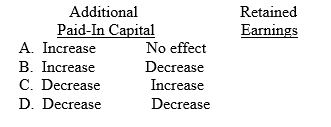

Five thousand shares of common stock with a par value of $10 per share were issued initially at $12 per share. Subsequently, 1,000 of these shares were acquired as treasury stock at $15 per share. Assuming that the par value method of accounting for treasury stock transactions is used, what is the effect of the acquisition of the treasury stock on each of the following?

Correct Answer:

Verified

Q2: Which of the following is an appropriate

Q12: The exercise price and market price of

Q16: Which of the following shareholder rights is

Q22: Treasury stock was acquired for cash at

Q25: When a property dividend is declared and

Q26: A restriction of retained earnings is most

Q26: When treasury stock is purchased for more

Q28: Unlike a stock split, a stock dividend

Q36: Undistributed stock dividends should be reported as

A)

Q40: When a property dividend is declared and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents