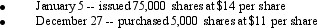

Victor Corporation was organized on January 2 with 100,000 authorized shares of $10 par value common stock. During the year, Victor had the following capital transactions:

Victor used the par value method to record the purchase of the treasury shares.

What would be the balance in the paid-in capital from treasury stock account at December 31?

A) $0

B) $5,000

C) $15,000

D) $20,000

Correct Answer:

Verified

Q44: Thomas Company reported the following for the

Q45: On June 1, Mason Company issued 8,000

Q46: On July 1, Black Corporation had 200,000

Q47: On June 1, 2011, Patriot Corporation declared

Q48: On February 24, BMC Company purchased 4,000

Q50: The Amelia Corporation was incorporated on January

Q51: On January 2, 2011, Stoner Corporation granted

Q52: On July 1, Rainbow Corporation issued 2,000

Q53: On December 10, Daniel Co. split its

Q54: Harbottle Corporation was organized on January 3,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents