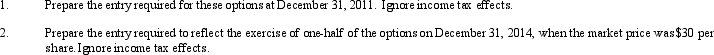

NRE Corporation has a stock option plan for its continuing employees that provides that each qualified employee may receive an option for a specified number of shares of the company's $1 par value stock. Employees must continue working for the company for three years to earn the grants, which may be exercised any time after the three years, at an option price of $10 per share. On January 1, 2011, employees were granted options for 3,000 shares when the market price was $16 per share. The fair value of the options was $24 each. The expected annual forfeiture rate is 5%. The accounting period ends December 31. NRE uses SFAS No. 123R in accounting for these options. Assume that the estimated and actual forfeiture rates are equal.

Required:

Correct Answer:

Verified

Q78: The Gradison Corporation had the following classes

Q79: On June 30, 2011, O'Hara Co. declared

Q80: During 2011, the following transactions related to

Q81: On January 1, 2010, Bartley Company initiated

Q81: A major conclusion of the FASB's standard

Q82: The following amounts were taken from the

Q83: Indicate how each of the following transactions

Q86: The FASB has been struggling with the

Q88: The accounts from the stockholders' equity section

Q97: The FASB has been struggling with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents