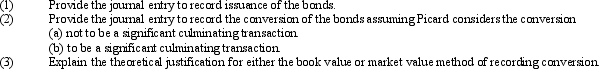

On January 2, 2006, Picard Enterprises issued $2,400,000 of 8 percent, 15-year semiannual coupon bonds to yield 7.5 percent. Each bond is convertible into 40 shares of $15 par common stock, which was trading at $20 per share on the date of the bond issue. The bonds were issued at 106. Without the conversion feature, the bonds would have been issued for 104.5.

On January 3, 2011, all of the bonds were converted into common stock. The market price of the stock was $28 per share on the date of conversion. The issue premium is amortized using the straight-line method.

Correct Answer:

Verified

Book v...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: On December 31, 2011, Carlton Corporation's current

Q93: On December 31, 2011, Anderson Company's current

Q94: On January 1, 2010, Kate Products issued

Q96: Johnson Corporation bought a new machine and

Q98: On May 1, 2010, J. Cumming acquired

Q101: A portion of the long-term liability footnote

Q102: The globalization of business has caused many

Q102: The price of a bond issue is

Q106: Footnote disclosures for long-term liabilities provide information

Q108: The Financial Accounting Standards Board issued Statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents