The price of a bond issue is determined by the market or effective rate of interest. A bond issue with a 10% stated interest rate will sell for less than face value if the market or effective rate of interest is 12%. The creditworthiness of the issuing entity is one of the factors that influence the market rate for a specific bond issue. Investors rely heavily on bond ratings provided by Standard & Poor's Corporation and by Moody's Investors Service, Inc.

Required:

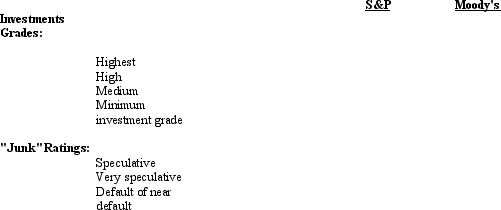

Complete the table below by entering the appropriate rating for each level of risk under the S&P and Moody's rating systems.

Correct Answer:

Verified

Q93: On December 31, 2011, Anderson Company's current

Q94: On January 1, 2010, Kate Products issued

Q96: Johnson Corporation bought a new machine and

Q97: On January 2, 2006, Picard Enterprises issued

Q98: On May 1, 2010, J. Cumming acquired

Q101: A portion of the long-term liability footnote

Q102: The globalization of business has caused many

Q103: Assume A Company has one asset, a

Q106: Footnote disclosures for long-term liabilities provide information

Q108: The Financial Accounting Standards Board issued Statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents