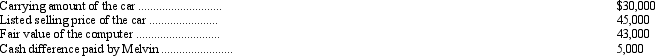

Melvin Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset. The following information relates to this exchange that took place on July 31, 2011:

The exchange has commercial substance.

On July 31, 2011, how much profit should Melvin recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Correct Answer:

Verified

Q22: Dewey Company purchased a machine that was

Q23: On January 1, 2009, Kalos Co. purchased

Q24: Hendricks Construction purchased a crane on January

Q25: On January 1, 2011, Carson Company purchased

Q26: Jordan Company exchanged a used autograph-signing machine

Q27: A company using the group depreciation method

Q28: In January, Hunter Corporation entered into a

Q29: Malone Company traded in an old machine

Q30: Overberg Company purchased a machine on January

Q31: On June 30, 2011, a fire in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents