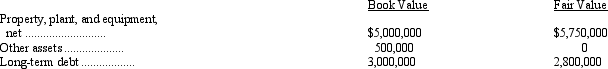

On July 31, 2011, Cleveland Company purchased for $4,000,000 cash all of the outstanding common stock of Gem Company when Gem's balance sheet showed net assets of $3,200,000. Gem's assets and liabilities had fair values different from the book values as follows:

As a result of the transaction, what amount will be shown as goodwill in the July 31, 2011, consolidated balance sheet of Cleveland Company and its wholly owned subsidiary, Gem Company?

A) $350,000

B) $250,000

C) $750,000

D) $800,000

Correct Answer:

Verified

Q19: Which of the following intangible assets does

Q20: A company is constructing an asset for

Q21: The Oscar Corporation acquired land, buildings, and

Q22: An expenditure subsequent to acquisition of assembly-line

Q23: On June 30, 2011, Hi-Tech Inc. purchased

Q25: On October 1, Takei, Inc. exchanged 8,000

Q26: During 2011, Krieger, Inc. incurred the following

Q27: Peyton Company started construction of a new

Q28: Jazz Company purchased land with a current

Q29: A machine with an original estimated useful

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents