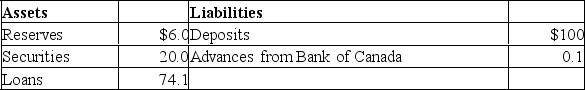

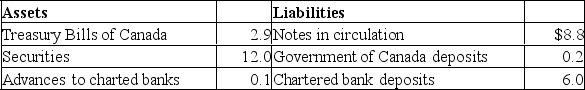

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.The chartered banks have excess reserves of:

Refer to the above information.The chartered banks have excess reserves of:

A) $1

B) $6

C) $20

D) $0

Correct Answer:

Verified

Q120: The reserves of the chartered banks are

Q121: Assume that the desired reserve ratio is

Q122: Which of the following is correct? When

Q123: Open-market operations change:

A)the size of the monetary

Q124: If the Bank of Canada buys government

Q126: When the Bank of Canada buys bonds

Q127: The purchase of government securities from the

Q128: Which of the following will not happen

Q129: Assume that the desired reserve ratio is

Q130: Suppose the Bank of Canada sells $2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents