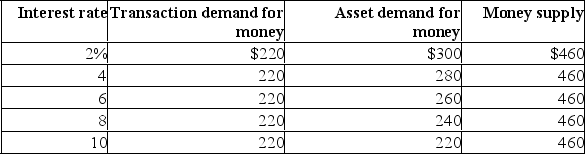

Assume that the desired reserve ratio is 10 percent and there are no excess reserves in the banking system.Also, suppose that the full-employment, non-inflationary level of GDP in this closed, private economy is $1,200.  Refer to the above information.An interest rate of 2 percent is not sustainable because:

Refer to the above information.An interest rate of 2 percent is not sustainable because:

A) the demand for bonds in the bond market will fall and the interest rate will fall.

B) the demand for bonds in the bond market will rise and the interest rate will fall.

C) the supply of bonds in the bond market will decline and the interest rate will rise.

D) the supply of bonds in the bond market will rise and the interest rate will rise.

Correct Answer:

Verified

Q178: The prime interest rate:

A)affects investment spending while

Q179: Which of the following would provide the

Q180: The purpose of a restrictive monetary policy

Q181: All else equal, when the Bank of

Q182: All else equal, when the Bank of

Q184: The purpose of an expansionary monetary policy

Q185: In terms of the aggregate demand and

Q186: In terms of the aggregate demand and

Q187: An increase in the money supply will

Q188: In recent years, the Bank of Canada

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents