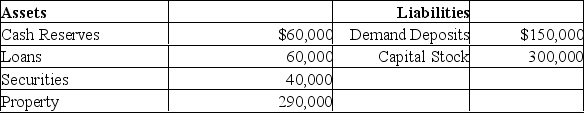

Answer the next questions based on the following balance sheet for a chartered bank.Assume the desired reserve ratio is 33%.  (a) What is the amount of excess reserves?

(a) What is the amount of excess reserves?

(b) By what amount can this bank safely expand its loans?

(c) By expanding its loans by the amount in part (b), what would its demand deposits equal (if all loans were made to customers holding demand deposits)?

(d) If cheques clear against the bank equal to the amount loaned in (b), how much would remain in reserves and in demand deposits?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Use the figures in the table below

Q17: What are near monies?

Q18: What is the difference between the M1

Q19: Suppose depositors at chartered banks transfer $10

Q20: What is the problem with printing money

Q22: What are the two significant characteristics of

Q23: Give an equation that shows the relationship

Q24: What are the four main assets of

Q25: What is the main method banks and

Q26: Define the desired reserve ratio.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents