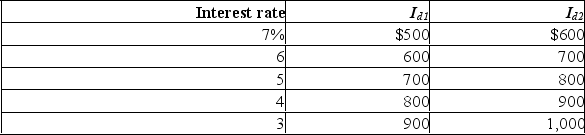

The table below gives data on interest rates and investment demand in a hypothetical economy.Figures are in billions.  (a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(b) Now assume that the deficit is used to improve the performance of the economy, and that as a consequence the investment-demand schedule changes from Id1 to Id2.At the same time, the interest rate rises from 5% to 6% as the government borrows money to finance the deficit.How much crowding-out of private investment will occur in this case?

(c) Graph the two investment-demand schedules on the graph below and show the difference between the two events.Put the interest rate on the vertical axis and the quantity of investment demanded on the horizontal axis.

Correct Answer:

Verified

(b) Ther...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Describe the impact of the European Sovereign

Q42: How can the effect of an expansionary

Q43: What are four real and potential problems

Q44: Is it possible to impose a burden

Q45: Is the public debt a burden on

Q47: Can a large public debt cause a

Q48: If the public debt is a debt

Q49: What two factors could reduce the net

Q50: Adam Smith once wrote: "What is prudence

Q51: Describe what occurred during the European Sovereign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents