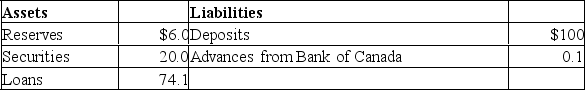

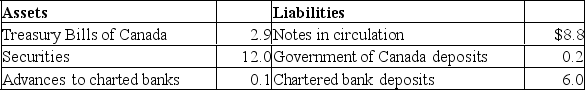

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.The maximum money-creating potential of the chartered banking system is:

Refer to the above information.The maximum money-creating potential of the chartered banking system is:

A) $5

B) $19

C) $20

D) $0

Correct Answer:

Verified

Q121: Assume that the desired reserve ratio is

Q122: Which of the following is correct? When

Q126: When the Bank of Canada buys bonds

Q127: The purchase of government securities from the

Q128: Which of the following will not happen

Q133: Assume the desired reserve ratio is 25

Q134: Which of the following statements is not

Q135: If the Bank of Canada sells government

Q137: Open-market operations refers to:

A)purchases of stocks in

Q138: Assume that the desired reserve ratio for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents