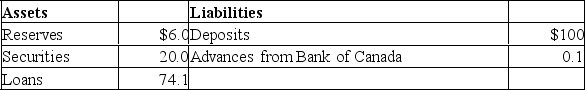

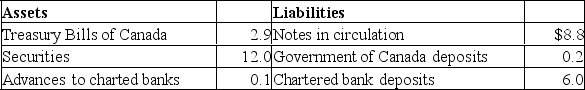

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

A) directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38.

B) directly increase by $40 and the money-creating potential of the chartered banking system will increase by $800.

C) directly increase by $2 and the money-creating potential of the chartered banking system will be unaffected.

D) be unaffected but the money-creating potential of the chartered banking system will increase by $40.

Correct Answer:

Verified

Q121: Assume that the desired reserve ratio is

Q123: Open-market operations change:

A)the size of the monetary

Q129: Assume that the desired reserve ratio is

Q132: Assume that a single chartered bank has

Q139: If the Bank of Canada buys government

Q149: Assume the desired reserve ratio is 25

Q156: To increase the overnight lending rate, the

Q158: To reduce the overnight lending rate, the

Q159: The bank rate is the rate of

Q160: If the chartered banking system borrows from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents