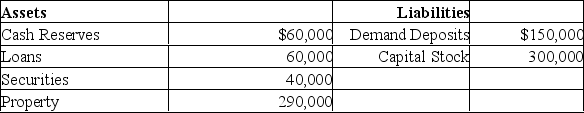

Answer the next questions based on the following balance sheet for a chartered bank.Assume the desired reserve ratio is 33%.  (a) What is the amount of excess reserves?

(a) What is the amount of excess reserves?

(b) By what amount can this bank safely expand its loans?

(c) By expanding its loans by the amount in part (b), what would its demand deposits equal (if all loans were made to customers holding demand deposits)?

(d) If cheques clear against the bank equal to the amount loaned in (b), how much would remain in reserves and in demand deposits?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Give an equation that shows the relationship

Q28: What are the five main liabilities of

Q32: What is Securitization and what are its

Q34: What is the function of the Canadian

Q39: How does the problem of Moral Hazard

Q40: Suppose the First National Bank has the

Q41: The following is the consolidated balance sheet

Q42: The following is the consolidated balance sheet

Q44: Define the monetary multiplier.

Q52: What are the two conflicting goals of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents