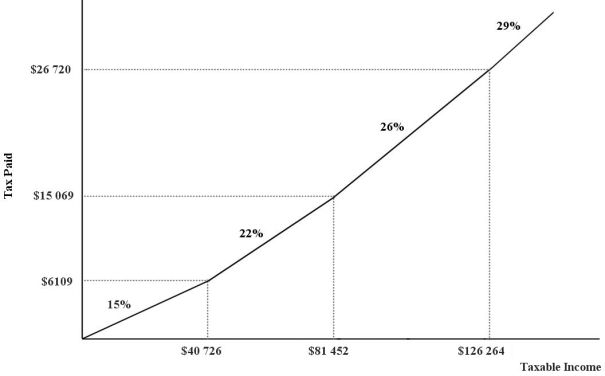

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. An individual with a taxable income of $98 125 will pay $ in income taxes.

A) 19 404

B) 22 513

C) 15 209

D) 28 456

E) 25 513

Correct Answer:

Verified

Q76: A tax that takes a smaller percentage

Q77: A "poverty trap" refers to the situation

Q78: According to Statistics Canada's definition, the percentage

Q79: If there were "horizontal equity" between all

Q80: The table below shows 2009 federal

Q82: An income tax is progressive if, as

Q83: Which of the following statements suggests that

Q84: An efficiency argument for public provision of

Q85: The concept of vertical equity is derived

Q86: The relevant objective in designing a tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents