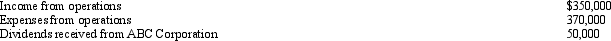

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: A taxpayer is considering the formation of

Q94: Ashley, a 70% shareholder of Wren Corporation,

Q95: Perry organized Cardinal Corporation 10 years ago

Q97: Penny, Miesha, and Sabrina transfer property to

Q100: Nick exchanges property (basis of $100,000; fair

Q127: Tan Corporation desires to set up a

Q128: Nancy,Guy,and Rod form Goldfinch Corporation with the

Q129: Sean,a sole proprietor,is engaged in a service

Q130: During the current year,Maroon Company had $125,000

Q135: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents