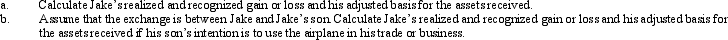

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Correct Answer:

Verified

Q101: Mandy and Greta form Tan, Inc., by

Q116: After 5 years of marriage, Dave and

Q188: Mitch owns 1,000 shares of Oriole Corporation

Q189: On January 15 of the current

Q192: Beth sells investment land (adjusted basis of

Q195: Eunice Jean exchanges land held for

Q198: For each of the following involuntary conversions,determine

Q199: Marsha transfers her personal use automobile to

Q243: What is the difference between the depreciation

Q254: Define fair market value as it relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents